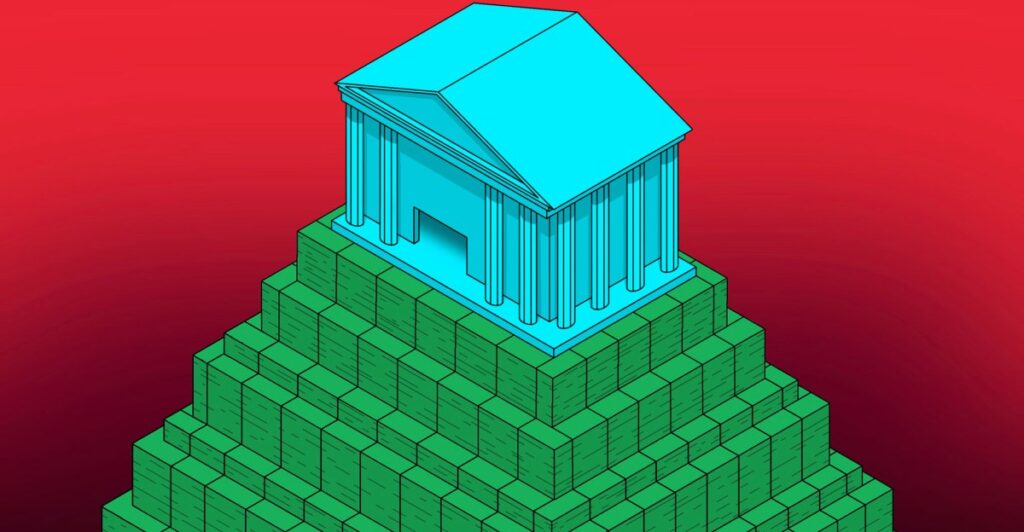

President Donald Trump’s tax legislation, known as the “Big Beautiful Bill,” is projected to allocate significant tax breaks to major corporations. An analysis from Senator Elizabeth Warren’s office indicates that Alphabet, Google’s parent company, could save approximately $17.9 billion in taxes this year. This amount is reportedly sufficient to finance Supplemental Nutrition Assistance Program (SNAP) benefits for about 7.5 million Americans.

Furthermore, the analysis suggests that this tax relief could cover Medicaid expenses for around 2.3 million adults or provide coverage for 5.4 million children. Amazon is expected to receive a tax break of approximately $15.7 billion, which could fund SNAP benefits for 6.6 million Americans or Medicaid for 2 million adults. Additionally, Microsoft is anticipated to benefit from a $12.5 billion tax cut in 2026, which might lead to lower Affordable Care Act (ACA) premiums for 1.9 million individuals.

Senator Warren’s statements highlight a notable concern regarding the impact of these tax breaks on social welfare programs. She argues that the legislative focus appears to prioritize substantial tax cuts for large corporations and wealthy individuals at the expense of critical support for low- and middle-income families. While Senator Warren’s comments assess the implications of the tax legislation, a broader inquiry remains about the potential long-term effects on public services and welfare programs due to such significant corporate tax reductions.

Source: https://www.theverge.com/news/816267/senator-elizabeth-warren-tax-break-microsoft-amazon