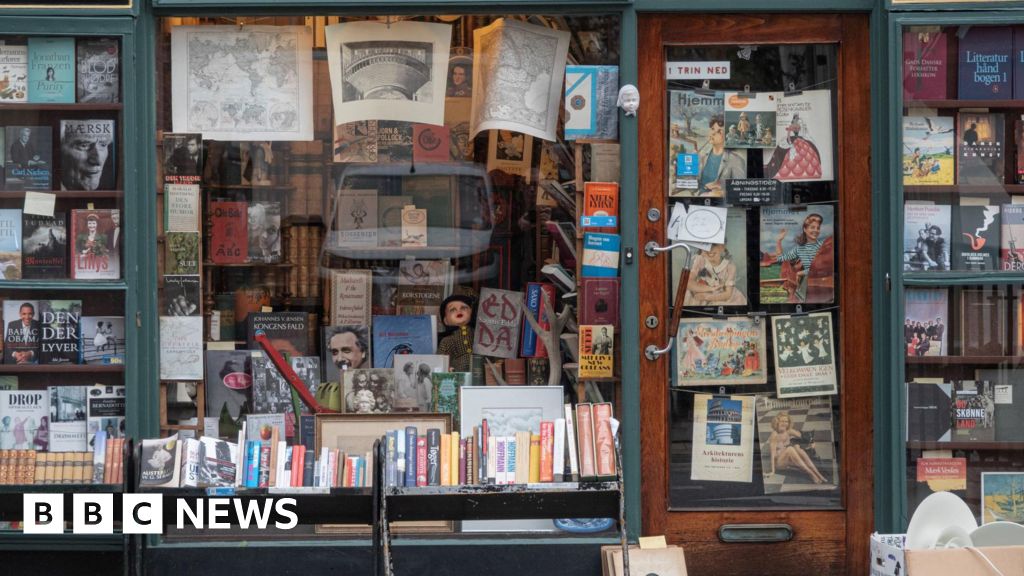

The Danish government has announced plans to abolish a 25% sales tax on books, aiming to address what is described as a “reading crisis” in the country. This tax, one of the highest globally, has been criticized for potentially discouraging book purchases. Culture Minister Jacob Engel-Schmidt expressed hope that removing the tax would increase book sales.

The measure is expected to cost the Danish government around 330 million kroner (approximately $50 million or £38 million) annually. According to data from the OECD, about 25% of Danish 15-year-olds struggle with understanding simple texts, raising concerns about literacy levels among youth.

Engel-Schmidt highlighted the worrying trend of declining reading proficiency among younger individuals and indicated a commitment to investing in the cultural consumption of the Danish population. Studies and surveys indicate significant drops in reading and comprehension skills among Danish teenagers, which Mads Rosendahl Thomsen, vice-chair of the government’s literature working group, has described as “pretty shocking.”

The situation is underscored by comparisons with neighboring countries: Finland, Sweden, and Norway, which have lower VAT rates on books—14%, 6%, and 0%, respectively—while the UK imposes no VAT on books at all. Thomsen noted that while younger children can develop their reading skills more easily, comprehension at the age of 15 is critical. He attributed some of the reading challenges faced by young people to the overwhelming number of distractions available to them today.

While Engel-Schmidt acknowledged that eliminating the VAT on books would not fully resolve the reading crisis, he argued it would enhance accessibility. The government’s working group on literature is also exploring avenues for promoting Danish literature abroad, digitalization of the book market, and its effects on authors’ remuneration.

Source: https://www.bbc.com/news/articles/crm48mvl33ro?at_medium=RSS&at_campaign=rss