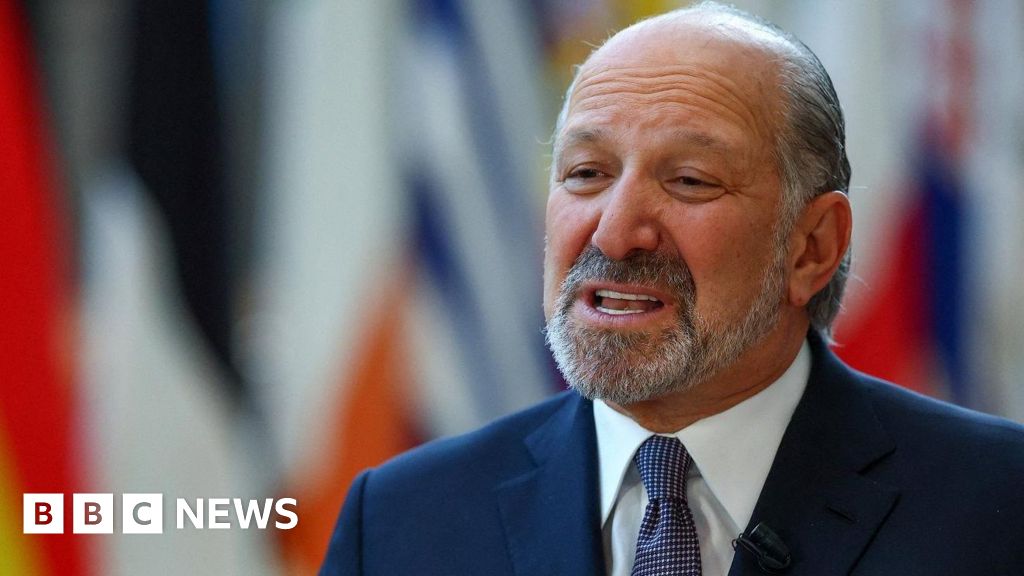

US Commerce Secretary Howard Lutnick has suggested that Europe should reconsider its taxes on major technology companies in order to potentially lower US tariff rates on European steel and aluminum exports. His remarks were made during ongoing discussions between US and European Union officials in Brussels, focusing on a trade framework established in July.

This agreement initially set US tariff rates on European goods at 15%, which was a reduction from previous threats, in exchange for European commitments to increase investments and import more American agricultural products. However, discrepancies remain, particularly over the current tariff duties. While European officials expected their metals exports to be subject to a 15% tariff under the agreement, the US still imposes a 50% duty and has broadened the range of products affected by this levy.

Moreover, Europe seeks exemptions from tariffs for specific items like wine, cheese, and pasta, similar to concessions recently granted by the Trump administration for tropical fruit and coffee. In a Bloomberg Television interview, Lutnick emphasized that the US administration is focused on affordability and is looking for digital tax concessions as part of the trade deal.

The US has consistently argued that these digital service taxes, which primarily affect larger companies earning revenue from streaming and digital advertising, disproportionately target American firms. Following the re-election of Donald Trump, many technology companies anticipated that he would advocate for a reduction in these taxes, in contrast to the Biden administration’s support for a globally negotiated solution. European Trade Commissioner Maroš Šefčovič reiterated that the EU considers the digital taxes non-negotiable, asserting that they are not discriminatory against American companies.

Source: https://www.bbc.com/news/articles/clydjnlm54po?at_medium=RSS&at_campaign=rss